5 steps on Investing Money

I get hundreds of emails daily asking me how to invest XYZ amount of money to "maximize returns while minimizing risk". I will try to provide a 5-step framework that should help most people evaluate their investment models/strategies.

Step 1:

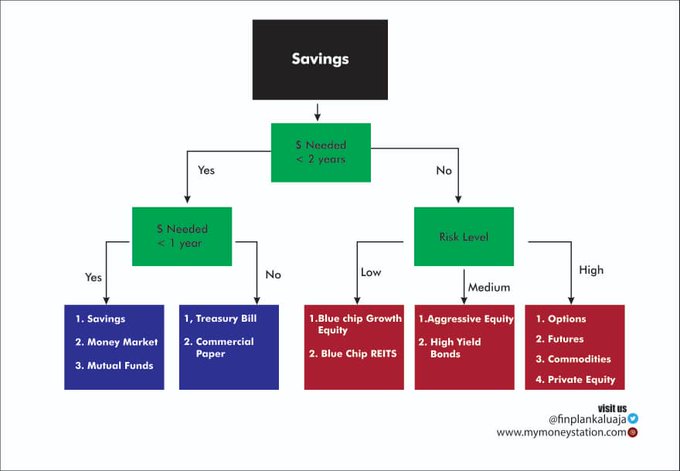

Balance risk and returns.

You can't "maximize returns while minimizing risk". Life doesn't work that way. It's "high risk, high returns" - stock, seed stage inv, crypto, day trading etc

or

"Low risk, low returns" - bond, money market, CDs, treasury bills etc.

Step 2.

Diversify.

Luckily, you don't have to chose "high risk, high returns" or "low risk, low returns". Instead you can diversify your investment to incorporate elements of both strategies through an investment portfolio. A portfolio balances your risk and rewards.

Read also : Financial intelligence 101 - Making the most out of the Nigerian economy.

Don't ever put all your savings in any investment instrument. Diversification is the only way to play the investment game. Don't ever buy a single stock; a mutual or index fund diversifies your risk. Always diversify. Repeat after me...ALWAYS DIVERSIFY.

Step 3:

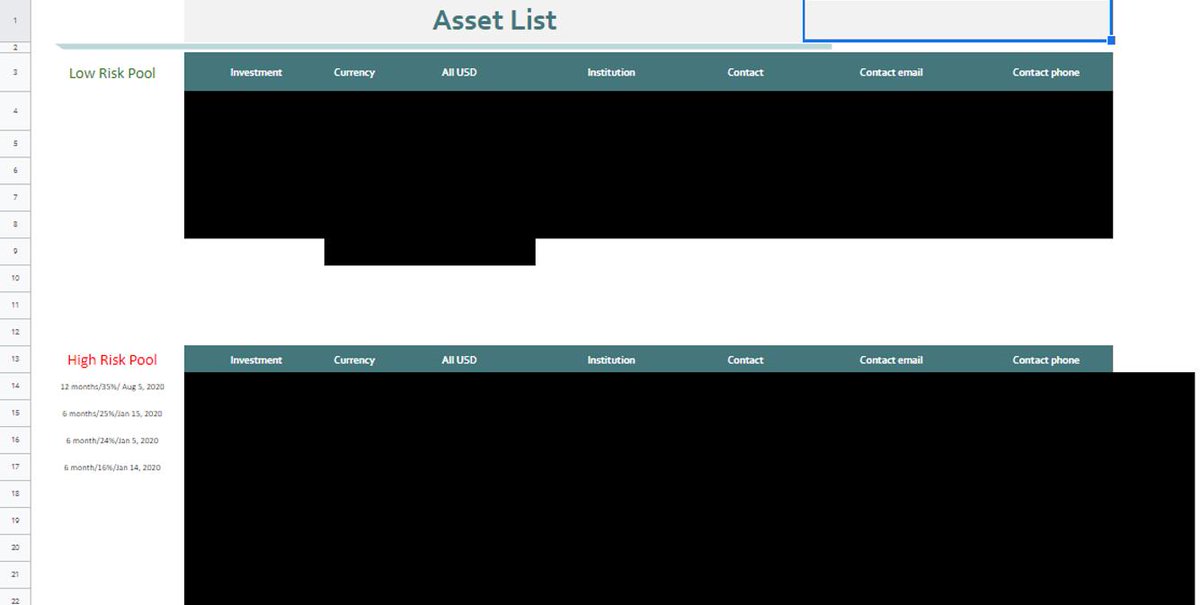

Create your portfolio

Split your investment funds into 3 buckets:

1. Long-term aggressive bucket (LAB) - Money you won't need in 5 -10 years (retirement planning)

2. Medium term balanced bucket (MBB) - 1 - 5 years

3. Short-term liquidity bucket (SLB) - within a year

Assign instruments to the 3 buckets:

1. LAB - stock mutual funds, index funds, real estate, crypto-currencies.

2. MBB - treasury bills, money market mutual funds, bonds, CDs

3. SLB - fixed deposits

Assign percentages to each bucket. Older investors need to be more conservative than younger ones.

Eg

45yo

LAB - 40%

MBB - 40%

SLB - 15%

25yo

LAB - 65%

MBB - 25%

SLB - 15%

60yo

LAB - 20%

MBB - 50%

SLB - 30%

Take some time to understand this. My preferred (43 year old married guy with kids) portfolio is:

LAB - 25%

MBB - 60%

SLB - 15%

Yep. I am very financially conservative and I hate losing money.

Step 4:

Read also : How to become a Permanent Resident in Canada through business or entrepreneur category.

Stick to your principles.

When a sweet investment deal comes along:

1. Place it in one of the buckets.

2. Review your percentages.

3. Decide how much you can put into it without messing with your portfolio percentages.

Don't EVER put all your savings in any investment.

Step 5

Start today.

If you have $500, create a portfolio and invest accordingly. Don't just keep your money in a savings account, always invest a portion of your savings.You may need to google some of these concepts to fully get it. But don't allow that to stop you.

I will try to answer some of your questions later today, and I hope to start an investment firm next year to help regular people access some of the higher value instruments.

Happy investing.

Global caveat: This is just a teaching session. It is not investment advise. Please speak to a personal finance professional to help you make specific decisions about your investments.

Read also : Tips on saving and investing in the UK.

Summary:

1. All investments have some degree of risk.

2. Diversify to balance risk and return.

3. Create a portfolio (multiple investments).

4. Stick to your principles.

5. Start now.

PS: Don't EVER invest more than 50% of your savings in a single instrument.

Author : Kekeocha Justin