Four Reasons to Engage an Accounting Service Consultant

Entrepreneurs are known to invest blood, sweat, tears, pain, money just name it when they decide to take the plunge and start off a new project or business. They gain and sharpen new skills as they move along the entrepreneurial way.

Often times, single handedly, they take up the responsibilities of the CEO, CFO, COO, and, a couple times, run domestic errands. It is ok if you're just getting started and trying to bootstrap your business. But then, as you move on, one thing is clear and that is: if you're sincerely serious about growing your business, then the days of doing the books on your own should end.

If you did not already outsource the bookkeeping or accounting service to an independent consultant before the business officially took off the ground, then you should consider hiring one to bring her expertise to bare for improving the company's growth prospects.

Quickly - Four reasons you should consider engaging an independent accounting consultant.

1. Follow the Law

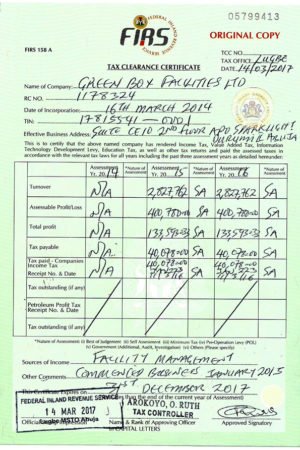

A big part of running a business involves ensuring it is compliant with the laws of the land. From paying taxes to completing the required legal and compliance documents for any business, an accountant can be the perfect liaison between a company and the law.

They can do include preparing annual statements of accounts, maintaining records of administrative personnel, handling payrolls and ensuring timely remittance of taxes so you don't fall short of the law and be exposed to penalties.

2. It's Not Just About Finances

It might be easy to assume that an independent accounting expert will solely be involved with the finances of a company. However, they offer much more. Because there are different legal structures to different businesses - from Sole Proprietorship to Limited Liability Companies etc...

An accountant can explain and help implement the right business structure Should a business owner speak to an accountant before the launch of his/her business, the accountant can guide on the best structure that best fits that'll easily save them time and money in the future.

3. Grow Their Business

An accountant can help guide business owners with financial decisions based on the long-term goals of their companies. Knowing that their companies are financially sound will improve the prospects of achieving their business' fullest potential.

4. Time Is Money

At some point, the business owner will have to delegate the financial work to an accountant so as to spend more time focusing on the execution and operation of the company. Spending more time growing the business rather than focusing on the financial and legal sides of the company will ultimately make the business more efficient.

If a business owner still frets about spending money engaging an independent accountant, then know that it is not necessary hiring one as a paid employee.

Why?You'll never appreciate their value.

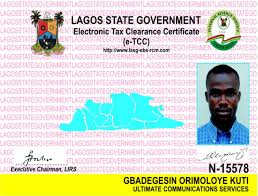

Read also : How Business Owners In Nigeria Can Obtain Tax Clearance Certificate With The F.I.R.S.

I hope this helps.

Chidera

PS

Need help with accounting & tax issues?

DM me.

Author : Kekeocha Justin