Tips on saving and investing in the UK

Remember, I am not a financial advisor. I am a woman who just likes to optimise available opportunities and share what I learn.

Also remember that my expertise is in Cloud and Data Security. I apply the principles of understanding Data and trends to my finances. If something does not make sense to me, I don’t do it (even when my financial advisor advocates for it). I believe if something is too complicated for me to understand, I won’t know when I am being taken advantage of

So any savings or investment strategy that cannot be explained in ways I can understand it is not worth my time. Yes, I am happy to miss out on being a billionaire because I don’t understand how Swiss Golden or One Coin works 🤷♀ï¸

I will not teach you how to budget, follow @MoneySavingExp or @WhichMoney for that. You can also read Budgeting 101 by @themotleyfool

Budgeting 101: How to Start Budgeting for the First Time

Read also : Financial intelligence 101 - Making the most out of the Nigerian economy.

However, I will say make sure you track your spending religiously and actively work to reduce them if you find any category unreasonable. I will also not teach you how to spot trends. That's what financial advisors are for. Now that you know what I will not do, here’s what I’ll do,

I will show you how I:

- Put plans in place to increase my income

- Save on bills

- Take advantage of tax benefits & keep up with changes

- Invest in different products

- Reduce impulsive spends

- Use tools to help automate savings, investments & track spending

My personal financial plan strategy is based on 2 things:

1. Jack Bogle’s writings and investment policies.

To learn more, buy and read his book here: - amzn.to/2zd03nN

2. Harold Pollack's “Personal finance advice on an index card”.

I came across this on an episode of @Freakonomics

Everything You Always Wanted to Know About Money (But Were Afraid to Ask) (Ep. 298)

Read also : 4 Reasons you should start investing early.

The only advise I’d give is: Treat yourself like you’re a company. Identify ways to increase revenue, compound interest on savings and reduce cost .

For context, my personal finance commandments:

1. 30% of my gross income goes into paying myself first. This money is distributed across my emergency fund, savings account, and mid-long term investment accounts

2. Buy Insurance, contribute to pension to the max allowed and create a will that is periodically reviewed and updated

3. Don’t buy a property just because you are in a rush to own a home.

Renting has a lot of benefits. Explore them and use them to your advantage so you always have money to save and invest. This goes for cars and other things perceived as assets

4. Take out a Credit Card to stagger payment of essential expenses.

Read also : 5 steps on Investing Money.

This gives me a headroom of 30 days to pay my bills instead of paying them immediately using my debit card. Sort of like a credit line facility that is available to companies. It means I can earn some money in my savings account & use the savings to pay my debt. The trick is to make sure you pay your credit card bill in full via Direct Debit and don’t withdraw cash on credit cards

5. Get a financial advisor. As soon as I was able to afford this, I put an one on retainer. I can’t rave enough about @aardvark_acc, my advisors. If you cannot get one yet, identify tax advantages in all situations by signing up to Google Alerts on any changes HMRC makes or following @Monevator and subscribe to their website monevator.com

Tips for saving and investing

Now that you know you are reading advice from a novice, I'll breakdown my tips into:

1. Earnings

2. Debts

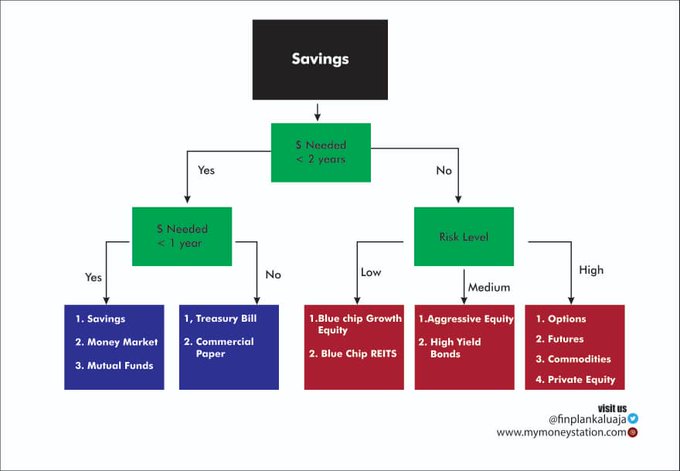

3. Savings

4. Investments

1. Earnings:

It's difficult to implement any personal financial plan if you cannot accurately predict your income and outgoings.Treat your life like it's an actual business.

To calculate your income, identify the:

- deductions your employer or HMRC makes from your gross income; and

- tax reliefs you are entitled to

A. Income

You need to be transparent with yourself about how much you earn before deductions. Then classify those deductions. This helps you identify if you can reduce what’s being deducted by either paying the deductions upfront or staggering the payment over a period of time

Read also : Important things to look out for before investing in a company.

If you have only one source of income, spend time doing a risk assessment on this . For example, I currently have one source of regular income and it is deliberate because I need to put in the hours into being a specialist so I can command a higher income.

Having a side hustle is distracting to that objective especially as I may expend so much energy into side hustles that may push me into a higher tax bracket with no added benefit.

The more experience and expertise I gain, the higher the chance of having additional income from speaking opportunities and writing about product management, data & cloud security

To mitigate any risk (i.e. loss of income because I can’t work etc.), I’ve taken out income protection insurance.

I’ll talk more about this.

For you, the opposite may be the case. You may be able to juggle 3 businesses or jobs without sacrificing productivity. Identify what works for you, optimise it, get insurance and stick to it

Read also : Three investment "instruments" to avoid.

B. Deductions

This is what remains in your bank account after taxes and other deductions are made from your gross income.

In the UK, the main income deductions are:

i. Income tax deductions are:

- 0% on earnings up to £12,500;

- 20% on btw £12,501 & £50,000; 40% on btw £50,001 to £150,000;and 45% tax on over £150,001).

For this tax year, go to Estimate your Income Tax for the current year to identify your deductions for the year.

Income tax applies to all money you earn (from your salary, side hustle, rental property, dividends, annual bonus, tips, benefits in kind, etc)

ii. National Insurance Tax: This is deducted from your gross pay and entitles you to certain state benefits, such as the State Pension and Maternity Allowance.

It is only deducted if you earn more than the standard Personal Allowance for the tax year (£12,500).

Track this closely because you get tax refunds if you’ve contributed more NI than you should have in a tax year

Read also : 9 things you need to start a successful freelance career.

iii. Student loans: these deductions are determined by your earning threshold and the Student Loan ‘Plan Type’ in place

2019 to 2020: Student and Postgraduate Loan deduction tables

iv. Pension Contributions: I will talk more about this when I get to the investment section.

But it’s wise to deduct this using the max allowed.

C. Tax Relief and Allowances

These reduce the amount of income tax you are liable for in a year.

They include:

i. Expenses related to business trips.

Here is a list of occupations that can deduct a flat rate allowance

Employment Income Manual

Read also : How to Sell your Knowledge and Experience.

ii. Professional Membership fees.

Approved professional organisations and learned societies (list 3)

iii. Work from home expenses if you are not wfh voluntarily(telephone, lighting, heating)

iv. Marriage allowance - if you are married or in a civil partnership and earn less than the personal allowance, you can transfer £1,250 of your unused personal allowance to your partner if they are a basic rate taxpayer.

If you’ve never claimed Marriage allowance, you can backdate your claim for any tax year since 2015.

Check if you are eligible here: Apply for Marriage Allowance

v. EIS/ SEIS tax relief - If you invest in eligible start up companies, you can claim 30% tax relief on investments up to 2m in a tax year.

Read more about this in an article by @SyndicateRoom EIS (Enterprise Investment Scheme) Tax Relief Guide For Investors

Read also : 7 ways to make 2020 better than 2019.

D. Essential expenses

- Council Tax (If you live alone, you are entitled to 25% discount)

- Rental Payments

- Communication (Phone, Internet bill)

Transportation

- Utility Bills (Water, Electricity, Heating)

Groceries

Now that you have an idea of:

- what deductions can be made from your gross income;

- essential expenses;

- tax reliefs you may be entitled to;

Write these down and identify if you can afford to save. You are an adult and I won’t tell you what to cut back on. I’d only tell you to identify if you can earn more to enjoy the items on your list so you can afford to save

We’ve talked about earnings and expenses. I’ll move on to debts.

Debts

I separated this from expenditure because in some cases, it’s prudent to save to pay a debt. In other cases, it makes sense to pay certain debts off as soon as possible

i. Payday loans: If you have never taken a payday loan, don’t. Especially if you want a mortgage.

Mortgage lenders typically don’t lend to people who have payday loans. If you have already taken one out, prioritise and pay them back ASAP.

Read also : Pricing Strategy for Business Owners.

Not only are they expensive debts, they adversely affect your credit rating.

If you are struggling with paying off expenses, there are many free advisers in the UK who help you find a way to manage your cash flow problems

Speak to @CitizensAdvice You can also contact @StepChange. stepchange.org

In other cases, it makes sense to pay debts off as soon as possible. One of the main reasons UK residents have enormous debts is taking out credit card debts/payday loans

a. Payday loans: If you have never taken a payday loan, don’t. Especially if you want a mortgage.

Mortgage lenders typically don’t lend to people who have payday loans If you have already taken one out, prioritise and pay them back ASAP. Not only are they expensive debts, they adversely affect your credit rating.

If you are struggling with paying off expenses, there are many free advisers in the UK who help you find a way to manage your cash flow problems: Chat with us online about debt

Read also : 7 simple Career Growth strategy.

Author : Kekeocha Justin