Important things to look out for before investing in a company

Before You Invest Your Cash In Any Company In The Country - Consider These Few Points To Make Informed Decision.

I’m going to use Agriculture or Agro Allied business as a template to drive home my point. But then, the information locked up in this write-up is applicable to any industry. So, you’d do well to take to heart the content of this thread and apply it accordingly to the space where you intend to play or invest your money. It’ll help.

Why are my using Agriculture or Agro-Allied businesses as a case study?

Because farming related businesses are beginning to spring up left, right and center and I’ve seen a few asking for investment from would-be participants to partake of the goodies they have to serve.

This is how MMM started. So, you’re better off being armed, than being vulnerable or at the mercy of smart fraudsters.

Many start-up businesses might not be able to stand the heat of the complex business environment we are in. And so, in the first five years of commencing business operations, they fizzle out.

A lot of business owners think running a business is a stroll in the park. The company structure on which their business is standing is faulty. Much worse, in a country like ours where we are being confronted with diverse erratic government policies. The challenge is gargantuan.

So, for investors who are interested in investing funds into a business, using the agro-allied business as an example, there are a few things that are of paramount importance that has to be radically analysed before you inject funds into the business.

This has nothing to do with emotions. They are critical success factors that have to be considered.

1. Consider the company and the leadership

You need to be extremely careful in selecting a company that is going to stand the test of time.

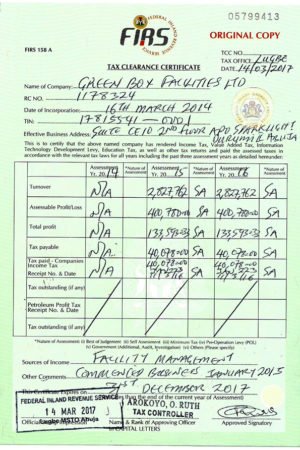

The easiest way to do this is to select only a company that has a track record of increasing sales and profits for at least five years. This narrows the field drastically. On the plus side, if the company you’re researching is publicly traded, so much the better. It will be easy to run through the audited financial statements of the company.

You’re looking for a company that is well managed, solvent, with manageable debt, that has reached a critical mass of distributors to sustain growth and has also been around long enough to have worked the teething problems.

Before you invest your money, ask yourself :

Read also : Financial intelligence 101 - Making the most out of the Nigerian economy.

What does this company's leadership team look like?

Study carefully at who's in charge.

How much experience do they have in this industry?

Have they run the company for a long time?

Does the company experience leadership issues?

Do they have a traceable history?...

Are they known in their industry?

How much do they tend to focus on their company?

Infact, carry out a comprehensive leadership audit.

Strong & sound leadership is essential for any company, and, it is particularly crucial for ones that hope to achieve long term stability and growth.

So, as an investor, that's usually what you want, so make sure not to miss out on any potential flag - red or green. Infact, this is the starting point. This is what is otherwise referred to ‘Due Diligence’.

To be continued...

Chidera

Author : Kekeocha Justin