How to Successfully Track Your Business Finances

As a start-up or veteran owner of a business, it is extremely vital for you to have a system that you follow to track your income and expenses. A structured accounting system by which every business financial transaction flows.

This system should be followed consistently and done weekly or monthly to record and manage your business finances. Your accounting system will show the operating procedures your bookkeeper or accountant will engage in keeping the books of accounts. This system allows for a follow through and will essentially let you know how your business is run.

Writing down and documenting these procedures will highlight for them areas that need improvement and tweaking and areas that are bringing you maximum operating efficiency. Managing your books regularly does not need to be a complicated task.

If you have a simple structured accounting system in place, it’ll function as an instructional guide to track your income and expenses.

Create a System?

Systems are the key to a successful business!

Systems are in every facet of your business, not just in your product or service line.

Having an accounting system in place will help you see where your business is thriving and where a breakdown might be occurring, so you can take the necessary actions to prevent financial stress or failure.

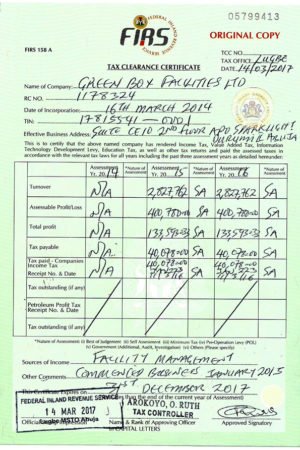

1. Documentation

You need to write down every expense to be incurred in a voucher-like form from start to finish. Depending on the nature of expense, petty cash voucher for petty expenses and cheque payment voucher for large sum payments...

Read also : Tips on saving and investing in the UK.

The whole idea is to get it all down as is, on paper. These are source documents your bookkeeper or accountant will work with. They will be able to assist you with finding ways to increase optimization in your process

2. Cash is king

Balance and reconcile your cash accounts. If your cash account is not reconciled regularly, you have no way of knowing what's going on in your business.

3. Who owes you and who do you owe?

Make sure your balance due to you from customers and the balance due to vendors are up to date and accurate at the end of every month. This is needed in order for you to make accurate cash flow forecasts that will keep your account in the black.

4. Adjustments

Make any necessary adjustments needed to ensure all of your balance sheet accounts are accurate. This is important because this statement tells the financial status of your business at any given point in time.

5. Review the reports

Review and analyze your monthly reports to determine if they accurately reflect how your business is operating. If not you may have to make some changes, but at least you will know in advance and not when it's too late.

Have you implemented an accounting system in your business? How has implementing it in your business helped you?

Kindly share your thought.

Chidera

Read also : Four Reasons to Engage an Accounting Service Consultant.

Author : Kekeocha Justin