Financial intelligence 101 - Making the most out of the Nigerian economy

This article will be broken own into two sections Financial intelligence and Nigerian economy.Before we start, a few caveats, this article is my opinion and do not constitute investment advise.

Financial Intelligence

Investing can be a science and art but it's always a planned activity Saving means you are deferring consumption. Investing is a planned deferral with a specific objective. Financial Intelligence is basically knowledge based investing.

Financial Intelligence is the how, why and when of investing. Alan Greenspan, the former US Federal Reserve Bank inferred "a lack of financial Intelligence is the number one problem of our generation" so Financial Intelligence is an important skill to have.

So how does an individual invest? what factors should be considered.

- Having an objective

- Agreeing a risk profile

- Determining investment objective.

An article speaks more about this, do read it later.

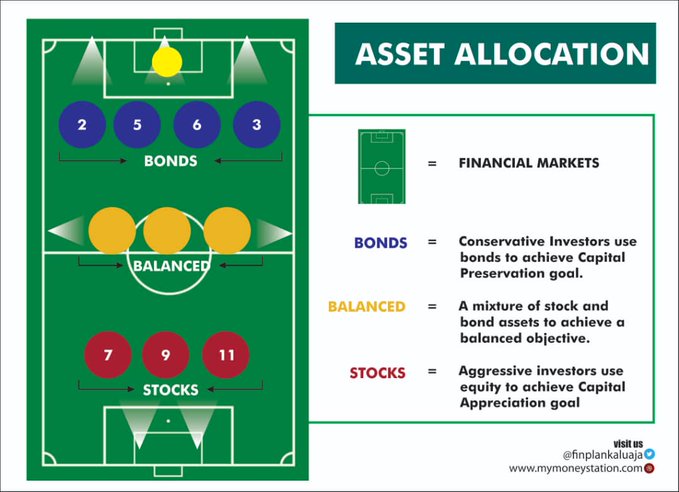

In summary, there is an investment spectrum with Capital Appreciation on one side and Capital Preservation on the other. When you invest, you are actually plotting your objective along this spectrum.

Read also : Nigerian Export-Import Bank (NEXIM) loan worth at least ₦10million.

e.g. "I want to save to buy a house in 5 years by investing 100k a month in a treasury bill." That's objective is Capital Preservation. You capital is safe, you are seeking to simply earn on invested capital. The risk level here is low.

e.g. 2 " I want to save for retirement, I am investing N100k in a stock mutual fund every year for 5 years" This is Capital Appreciation, in this instance your are putting your capital in play to grow the initial capital. Risk here is higher.

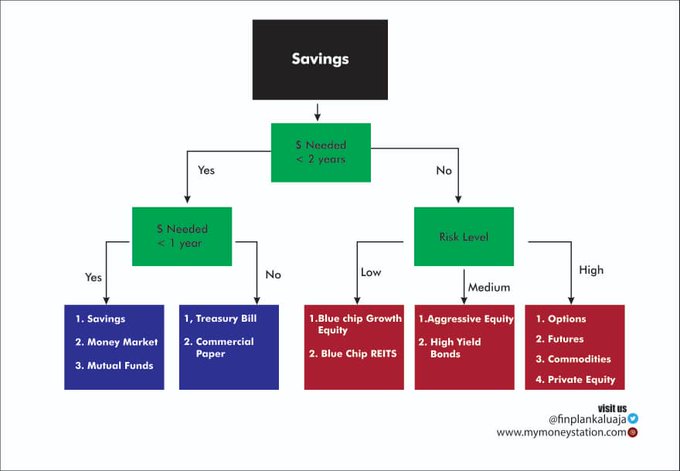

Financial Intelligence gives a framework to determine how to match investments to objectives. Two Infographics. This decision tree walks the investor via questions to specific asset classes. eg if you need your investment returns in less than a year, then no equity.

Read also : Bank of Industry (BOI) loan.

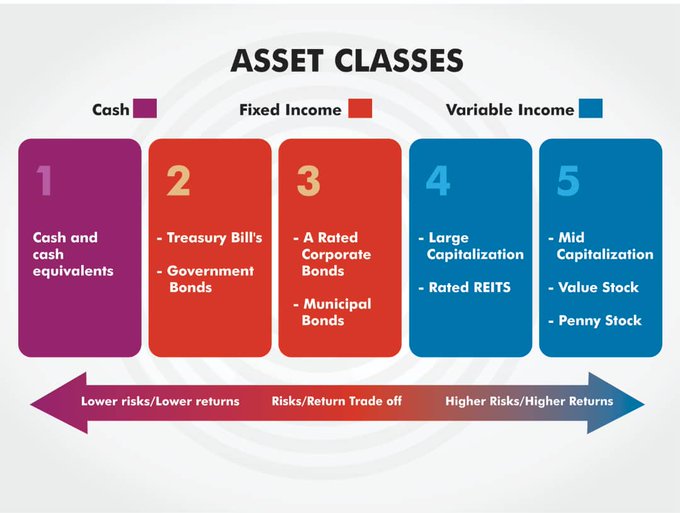

This second infographic on Asset Classes lays out risk and reward again matching them to assets.. Capital Appreciation is taking risk Capital Preservation is less risk.

Read also : CBN loan worth up to ₦2billion Naira.

These infographics show a purpose based investment plan, i.e. you are investing to meet a predetermined investment goal NOT a return. DO NOT chase returns, Invest to meet a predetermined financial goal. If 2 investors will have different goals, they will have different plans.

In summary about financial intelligence.

- Have a plan

- Start to implement your plan early

- Pay yourself first

- Be constant, invest constantly

- Watch inflation

Making the most of the Nigerian economy

What are we certain of? The FGN is going to borrow N5.2b a day, yes day. FGN investments are considered "risk free" cause the FGN will meet Naira obligations, (even if it prints) How can an investor take advantage of this?

- Agree your investment objective and tenor

- Find the Inflation rate, write down

- Find FG investments that corresponds to your investment tenor, write down rate

- Get the current Nigeria Stock Exchange All Share Index

- If the NSE ASI ("Risky") is trending more than the selected FGN bond return and inflation, buy more shares, subject to your age.

- If FGN bonds ("risk free") are returning more than NSE ASI, buy more FGN bonds. Earn a higher return, "risk free".

Whatever strategy you agree or come up with should be expressed in an Asset Allocation plan, which is basically how you allocate your capital to various assets ie diversification to meet that clear investment objective.

Read also : 5 Steps to Study in the USA.

Let me quote Warren Buffett "be fearful when others are greedy, be greedy when others are fearful"

So

What investment today are Nigerians fearful about? What investment are Nigerians greedy about?

Read also : Bank of Agriculture (BOA) Loan worth at least ₦5million.

Finally Ponzi scheme are not investments. Currency trading is speculation and gambling. You can lose all your capital buying shares FGN bonds enemy is inflation Dollar return is really low Euro and Yen return are negative Thank You.

Author : Kekeocha Justin